Over cumulative 40,000 users !!

HS code Search

Just enter the item name !HS code confirmation is for only 1 second !

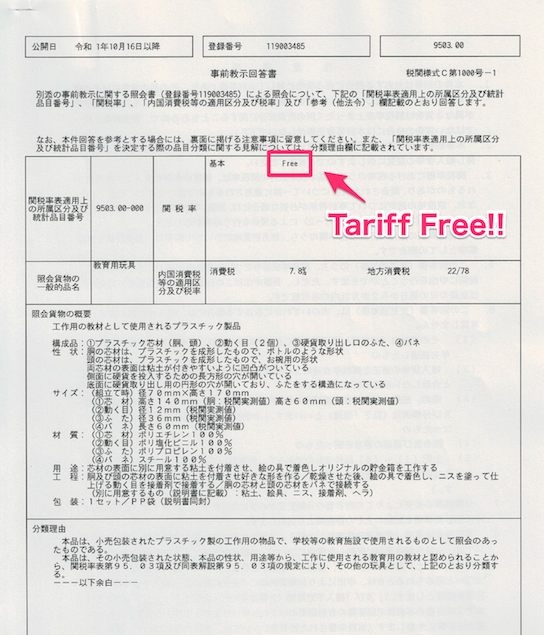

Tariff will be zero!

Tariff reduction diagnostic tool for forwarders released!

HS Code confirmation is for only 1 second.

You will no longer need to worry about which number HS code is. By using the HS CODER, you can find the HS code for the product instantly.

Only to enter the item name of the product

If you describe the item name of the product that you want to search at the top of the screen, you can see the candidates and references of the HS code and obtain the appropriate HS code.

HS CODE RELATED INFORMATION ONLY

By selecting only the HS code information from the Internet, you can select an appropriate HS code.

SEARCH START AT THE SAME TIME AS ITEM NAME INPUT

Search engine has started at the same time as input of item name and you can get the HS code immediately.

SIMPLE DESIGN

To maximizing the search speed, extra decoration is eliminated and the display is simple.

ANYONE, ANYTIME, ANYWHERE

If there is Internet access, the search is available to anyone, anywhere, anytime.

“6-digit HS code of the exported product was found, but Japan has adopted a 9-digit HS code, please tell us tariff rates in the 9-digit level.”

“It has been found to be able to take advantage of the EPA / FTA for exported product, but please tell us what kind of procedure will be needed for zero tariff. We do not know well the difference of the specific certificate of origin and the normal certificate of origin.”

“We do not know how to apply CTC rules or VA rules for issuing certificate of origin by FTA / EPA. For CTC rules, it takes too much time to get HS code of parts for our product which has many parts.”

In response to such customer feedback, in addition to the HS code search service using HS CODER, we are supporting the issuance of specific certificates of origin necessary for applying the preferential tax rate of EPA / FTA. Specifically, the following services are provided.

1 Consultation with specialists2 Outsourcing for certificate of origin

Support for issue of Specific certificate of origin

Issuing a specific certificate of origin is essential for applying preferential tax rates using the Economic Partnership Agreement (EPA) or Free Trade Agreement (FTA). We support the following steps to prove the originality of the exported products that require the most expertise.

Step1 Confirm HS code of products to be exported

Confirm the 6-digit HS code of the product to be exported.

Step2 Existence of EPA / FTA preferential tax rate and confirmation of tax rate

Check whether there is an EPA / FTA preferential tax rate and the tax rate for the product you are exporting.

Step3 Confirmation of rules of origin defined in EPA / FTA

In order to receive the EPA / FTA preferential tax rate, it is necessary to confirm the rules of origin applicable to the exported product.

(Note) Rules of Origin are rules for determining the origin of goods, including Change in Tariff Classification (CTC rules) and Value Added (VA rules).

Step4 Confirming the origin of export products

In order to be subject to the EPA / FTA preferential tax rate at the import country's customs office, it is necessary to have a qualification of origin based on the rules of origin established in each EPA / FTA.

(Note) EPA / FTA refers to a product with originality as a “specific origin product”.

1 Consultation with specialists

We support the application of preferential tariff rates using the Economic Partnership Agreement (EPA) and Free Trade Agreement (FTA).Please feel free to ask us.

2 Outsourcing for certificate of origin

We will confirm the rules of origin for EPA / FTA (CTC rules and VA rules) and create a certificate of origin.

Service Fee

There are two types of services which are consulting services that provide expert experience and knowledgeand services that outsource all certificate of origin operations, including time-consuming certificate creation operations.

FAQs

Is the consultation with specialists available by phone or Skype?

We also accept consultations over telephone and video conferencing. Please inform us when you apply. In addition, we accept consultation by visit, but in that case we ask you to bear the actual transportation costs.

How is the estimate of the outsourcing fee for the certificate of origin operations determined?

Normally, it is $980 per product with an upper limit of 10 components. However, if the number of parts that make up the product is enormous and more man-hours are required than usual, the estimated fee will be determined according to the number of parts.

Is payment possible other than bank transfer?

Sorry. Payment method is only bank transfer.